Earn Rental Income from the Indian Stock Market with the Covered Call Strategy

Many Indian investors look to real estate for steady rental income. But there’s a lesser-known way to generate similar income from the stock market — using the covered call option strategy. This technique allows you to earn regular returns from stocks you already own, much like collecting rent from a property.

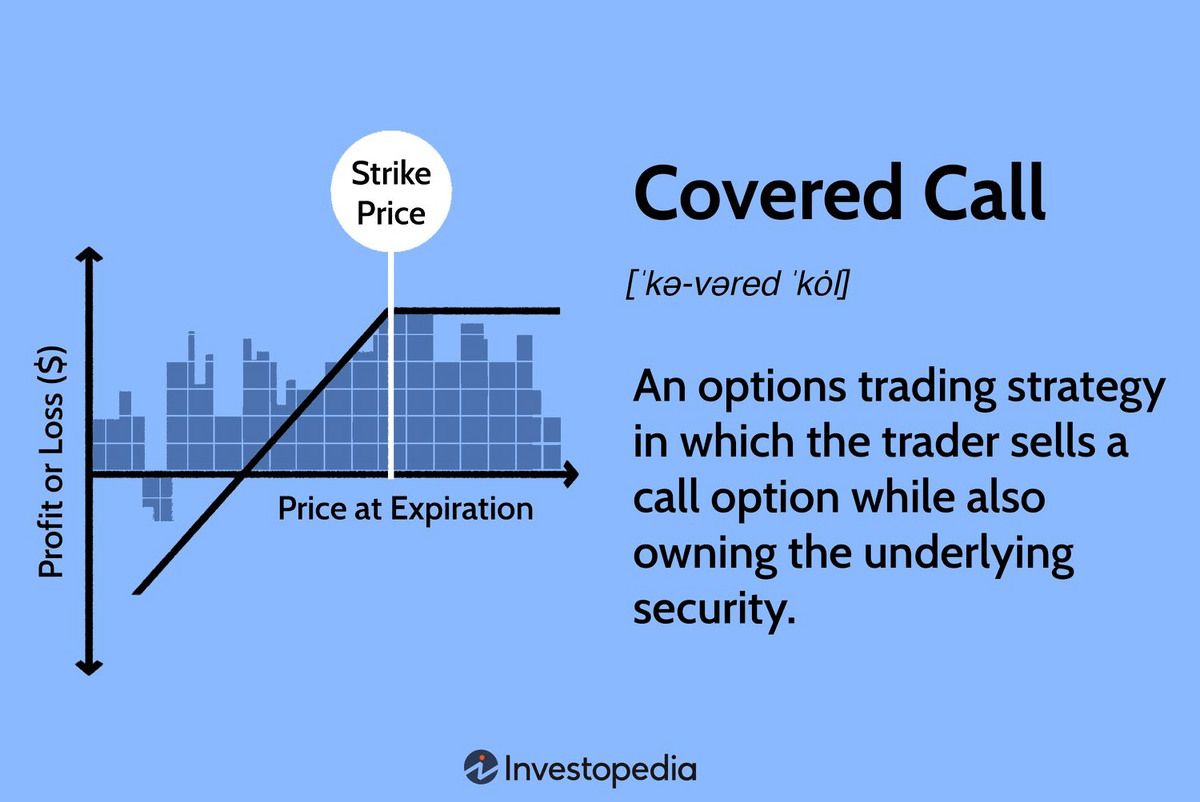

A covered call involves two steps: first, you must own shares of a stock listed in the F&O (Futures and Options) segment of NSE or BSE; second, you sell (or “write”) a call option on that stock. When you sell the call option, you receive a premium — this is your immediate income, regardless of whether the option is exercised or not.

For example, suppose you own 1 lot (typically 500 shares) of Infosys trading at ₹1,400. You sell a 1-month call option with a strike price of ₹1,500 and receive a premium of ₹20 per share. That’s ₹10,000 (₹20 × 500) in upfront income — your equivalent of rental earnings. If Infosys stays below ₹1,500 until expiry, the option expires worthless, and you keep the shares and the premium. If it rises above ₹1,500, your shares may be sold at that price, but you still retain the premium and gain on the stock up to ₹1,500.

This strategy is most effective in a sideways or moderately bullish market, and it’s ideal for long-term investors holding large-cap, stable stocks. While it limits upside potential, it adds regular cash flow to your portfolio.

With discipline and proper risk management, covered calls offer a powerful tool for Indian investors to create a monthly income stream, similar to rent — but without the headaches of tenants and property maintenance.