In the volatile environment of the Indian stock market, protecting your investments is crucial. One effective strategy that investors use to safeguard their portfolio from unexpected downturns is the Protective Put options trading strategy. This approach is especially relevant for retail investors in India who want to hedge their equity positions without liquidating them.

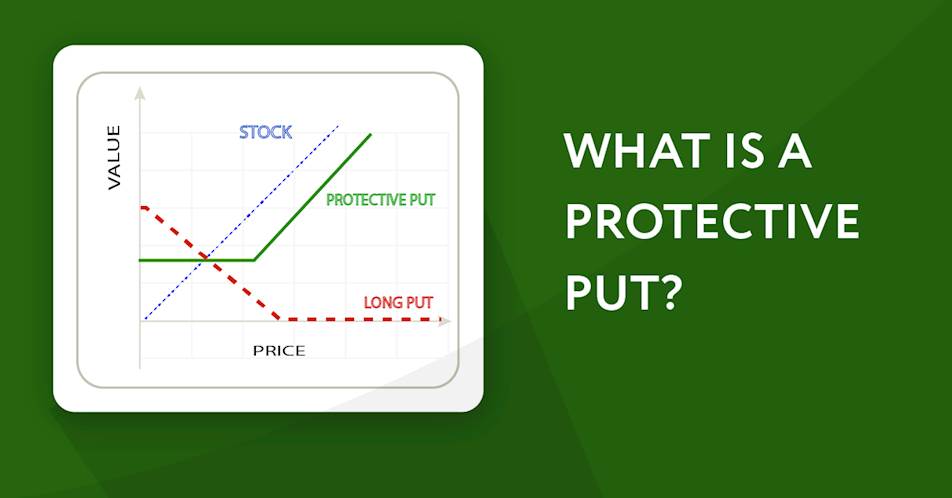

A protective put involves buying a put option for a stock you already own. A put option gives you the right to sell the stock at a predetermined price (strike price) before a specific expiry date. This strategy acts like insurance—limiting your losses if the stock price falls sharply.

Example in the Indian Market

Suppose you hold 1 lot (say, 100 shares) of Reliance Industries, currently trading at ₹2,800. You’re optimistic in the long run but concerned about short-term market fluctuations. You can buy a put option with a strike price of ₹2,700 expiring in the current or next month. If Reliance drops below ₹2,700, the put gains value, offsetting your loss in the stock.

Key Benefits in Indian Context

Risk Management: Limits downside risk while allowing full participation in upside potential.

Capital Preservation: Especially useful during earnings season, policy announcements, or global uncertainty.

Psychological Comfort: Helps avoid panic selling during temporary market dips.

SEBI-Regulated Derivatives: The Indian derivatives market is well-regulated, and options are available for many large-cap Nifty stocks.

In conclusion, the protective put strategy offers Indian investors a balanced way to manage portfolio risk without exiting positions. It is a smart strategy for those looking to stay invested while insulating themselves from short-term market shocks.